For years, the high US corporate withholding tax rate has encouraged companies to accumulate large offshore cash and investment holdings. This pile is now $2.4 trillion in size, including $800 billion of long-term investments such as corporate bonds, according to Factset. That amounts to 13.6% of S&P 500 market capitalisation.

For some companies, the cash and investments are particularly outsized. Apple, Inc. owns $150 billion of corporate bonds mostly held offshore, more than the holdings of the European Central Bank, along with $70 billion of US Treasuries and mortgage-backed-securities. The company currently spends about $11 billion a quarter in dividends and share buybacks, and has over $100 billion debt, but none of this has been enough to slow the growth in Apple’s investment pile.

US Congress has now passed reforms which would lower the tax rate from 35 percent to 21 percent. The hope is that this will encourage companies to repatriate their cash, boosting the US economy. The impact of $2.4 trillion flowing back to the US would be far reaching, not least on other market participants that held the same bonds or cash investments.

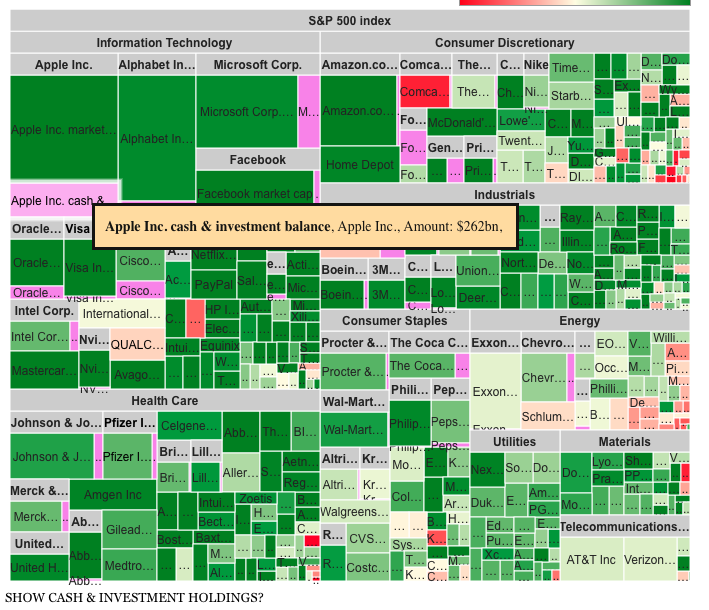

Risky Finance has prepared an interactive visualisation to show the scale of the issue. The screenshot below shows non-financial members of the S&P 500 index as squares sized according to market cap, and coloured by year-to-date return with price increases in green and declines in red.

“I am optimistic given what I’m hearing that there would likely be some sort of tax reform this year, and it does seem like there are people in both parties that would favor repatriation as a part of that. So I think that’s very good for the country and good for Apple.”

– Tim Cook, Apple, 31 January

“A shift on repatriation of foreign earnings…would be a permanent solution, which we would be very happy with and that would certainly give us more flexibility. It gives us flexibility across M&A; it gives us flexibility across dividends; it gives us flexibility across buybacks. And then there is also tax reform. And lower corporate tax rates really are the levers for investment in an operating environment, and that’s actually where I think the jobs get created”

– Chuck Robbins, Cisco Systems, 12 December

Levelling the Playing Field

Levelling the Playing Field

Barclays and Labour's growth plan

Barclays and Labour's growth plan

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Dimon rolls trading dice with excess capital

Dimon rolls trading dice with excess capital