Risky Finance was launched in August 2016 and incorporates content from the Nickdunbar.net blog going back to 2009. To mark the end of the decade, we’ve compiled a list of the most popular articles and have included some charts by way of an update.

Published in 2011, The Devil’s Derivatives was a no-holds barred account of the financial innovation and regulatory blunders that led to the 2008-9 financial crisis. It also documented the shift to quasi-permanent central bank support of markets that has crushed volatility and entrenched inequality.

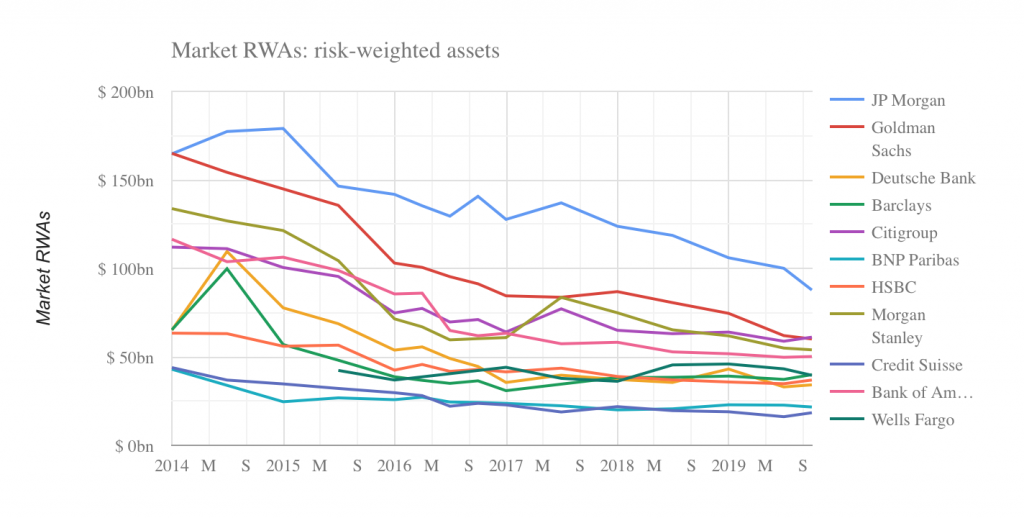

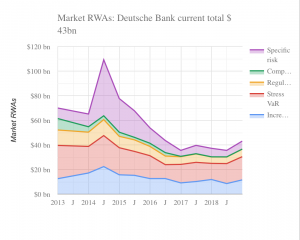

For this 2012 follow-up article to the Devil’s Derivatives, I spoke to the inventor of value-at-risk, Jacques Longerstaey. He recounted how JP Morgan publicised the innovation to influence bank regulations, allowing unfettered trading book leverage. After the crisis, regulators cracked down on risk models and proprietary trading. Using the Risky Finance banking tool database which starts at the end of 2013, we see how the largest banks subsequently reduced market risk capital requirements as they wound down or exited once-profitable trading businesses.

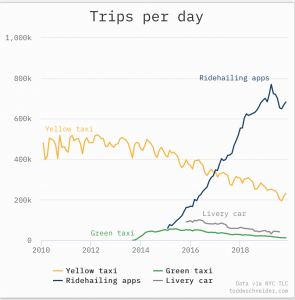

This 2014 article used a report into an Irish plane crash to examine whether disruptive, decentralised business models were successful because they sidestepped regulation. Case in point was Uber, then a $5 billion ‘unicorn’ that already was courting controversy with its army of gig-economy drivers. Regulators have put obstacles in Uber’s path and its self-driving car program has been stalled after killing a pedestrian. That hasn’t prevented Uber reaching its current market capitalisation of $51 billion, while mortally wounding traditional taxi services in cities like New York.

In this article from December 2015 looked at the vulnerability of the dollar high yield market, which at the time was being dragged down by troubled US oil exploration companies. Since then the market has shrugged off such wobbles, and has grown by some $500 billion, notably emerging market corporates such as Chinese real estate issuers. The article included the first visualisation of IHSMarkit iBoxx bond data, now incorporated into our subscriber corporate bond and sovereign bond tools.

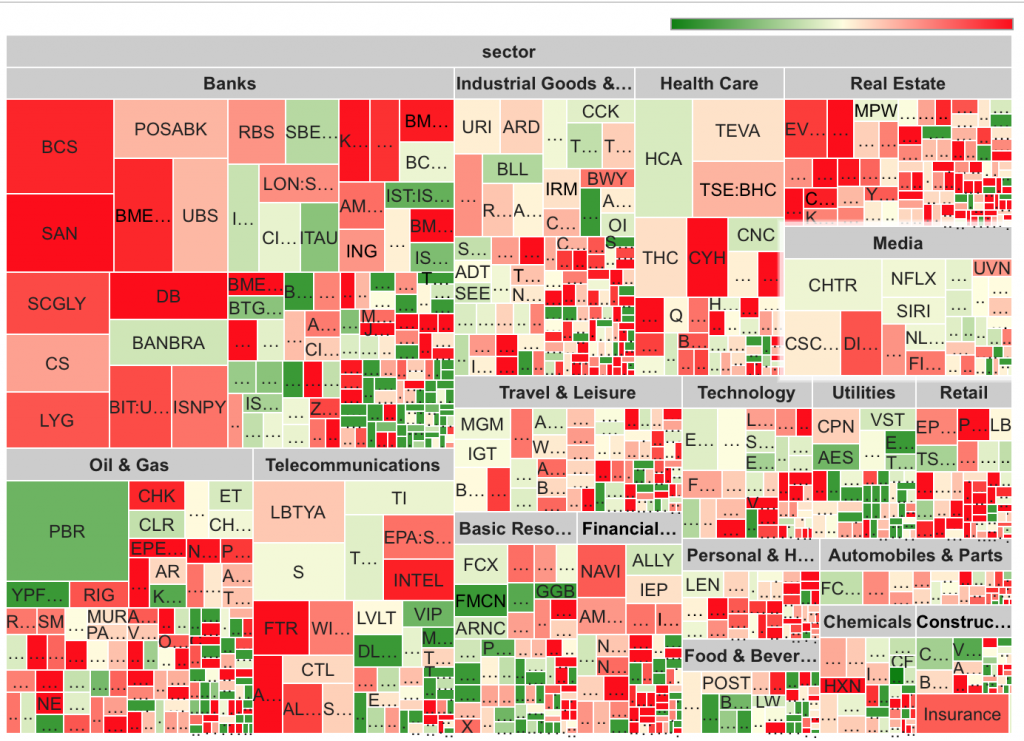

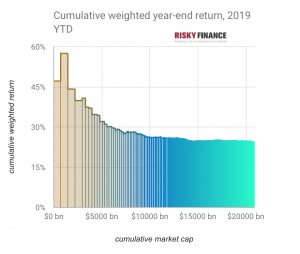

Thomas Piketty may have started the global debate on inequality in 2013 with his book ‘Capital in the 21st Century’, but we applied the concept to equity markets at the moment megacap technology stocks began to surge past the also-rans. Our 2016 article includes three visualisations. Since then, we have revisited the theme several times as the surge continued with barely a hiccup (the brief correction late in 2018 was enough to push the Federal Reserve into a policy reversal). This year, $7 trillion of market cap was added to the S&P 500, mostly benefiting the richest people on the planet.

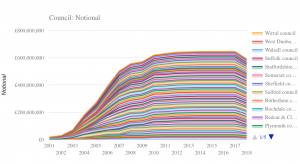

We wouldn’t expect US and other non-UK readers to show much interest in UK bank lending to local authorities. But this series of articles that began in 2014 were among the most influential we have published. Our expose of lender option borrower option (LOBO) loans led to a Channel 4 TV documentary, political upsets at top-borrowing councils and ultimately a swathe of restructuring in which Risky Finance and its partner Vedanta Hedging Limited played an important role.

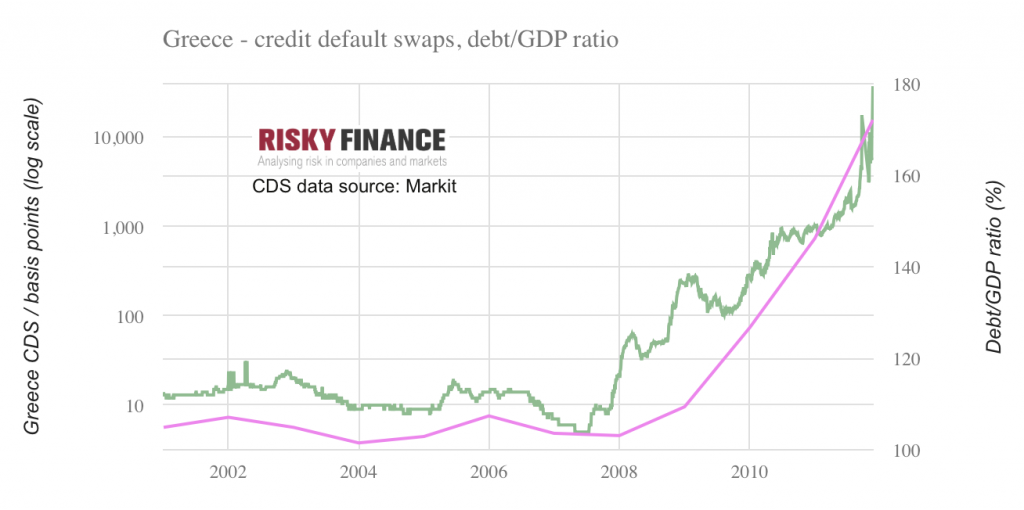

Our coverage of Greek debt goes back to 2003 when we first exposed the country’s use of swaps sold by Goldman to help conceal debt. By the time this article was published in 2011, the Eurozone debt crisis was in full swing and the role of derivatives was a concern for regulators and central banks. As it turned out, the triggering of Greek CDS contracts in March 2012 was a non-event, with the main story being how the European Central Bank, governments and the IMF wrote down Greek debt in all but name. Seven austerity-ridden years later, Greece is now a Eurozone success story.

The German banking giant played a central role in The Devil’s Derivatives, but the real investor backlash against Deutsche Bank didn’t begin in earnest until around 2010. During the following nine years, with three different CEOs, the bank’s share price lost 90% of its value. By the time this article was published in early 2016, the bank was increasingly seen as a source of systemic risk. The article includes a visualisation of Deutsche’s regulatory capital, using the Risky Finance banking tool, and we continue to track Deutsche’s mixed results in risk reduction.

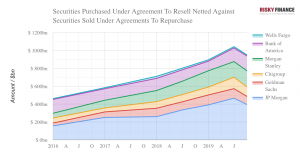

Our most recent article is also one of our most popular. And it takes us back full circle to a theme that The Devil’s Derivatives discussed eight years ago – how the pressure on systemically important global banks to boost shareholder returns clashes with their role underpinning the financial system. As JP Morgan shows, regulators still haven’t worked out how to deal with this problem.

To many people, Nassim Taleb is the Donald Trump of intellectuals – often wrong, always spoiling for an argument yet notoriously thin-skinned, part of the elite while vociferously anti-establishment. My December 2012 review of his book Antifragile took aim at Taleb’s revisionist approach to option pricing and his hostility to subjective probability. It was the most popular book review published on this site.