There was over $12 trillion of corporate debt outstanding in three major currencies when the coronavirus spread from China, killing thousands and prompting lockdowns across dozens of countries.

One day, historians will teach us how obvious it all was: This was the consequence of a huge risk no one took seriously. Forcing billions of people to stay at home would bring the global economy to a grinding halt. And companies that depend on those consumers would come to a grinding halt too, prompting instant mass unemployment and a recession deeper than the last financial crisis.

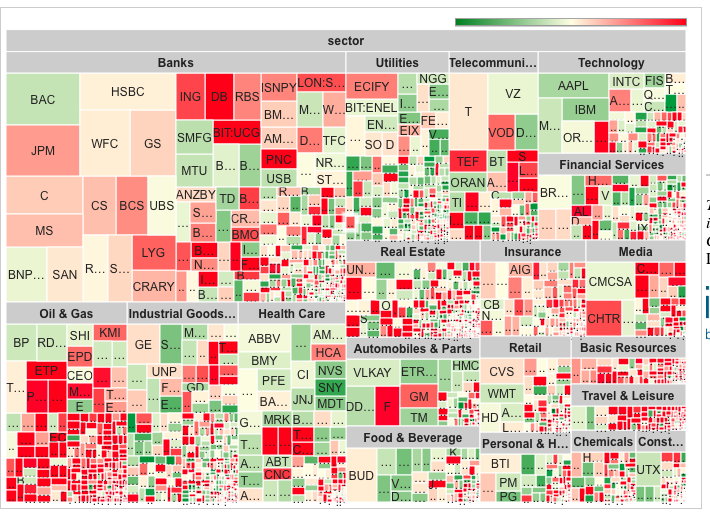

And how about the investors (ultimately pensioners) that provided funding to these same companies? Unlike equities, where $6.5 trillion has been wiped off the value of the S&P 500 index alone, the carnage in credit is harder to see, but no less alarming. Can emergency action by the Fed, Bank of England and European Central Bank keep these companies alive amid the lockdowns?

With the help of IHS Markit iBoxx data, Risky Finance tracks the corporate bond market. Below we tell the story using charts taken from our interactive credit tool.

In August last year, there were more than $1.2 trillion of corporate bonds trading at a negative yield. That was partly driven by European Central Bank easing but also by record low credit spreads. Even ECB-ineligible junk bonds were caught up in the excitement.

On 18 March, the day before the ECB finally fired its €750 billion bazooka (the Pandemic Emergency Purchase Programme), only a few billion of negative yield corporate bonds traded. The reason? A massive widening in credit spreads as investors digested the prospect of the global economy falling off a cliff. When markets closed the following day, there were no negative yield bonds at all.

Comments are closed.

Levelling the Playing Field

Levelling the Playing Field

Barclays and Labour's growth plan

Barclays and Labour's growth plan

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Dimon rolls trading dice with excess capital

Dimon rolls trading dice with excess capital

[…] How Covid-19 infected the corporate bond market […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Source […]

[…] Covid-19 sent corporate bonds into a tailspin in March, it set in motion a game of chicken at overleveraged companies. Like James Dean and his rivals in […]