As the coronavirus pandemic spread, the US treasury curve fell by 120 basis points in the space of a few weeks – compared to 80bps in the whole of 2019. With the first quarter earnings season just a month away, the bond volatility highlights the interest rate bets lurking in the balance sheets of the biggest US banks.

According to Risky Finance estimates, Bank of America, faces an $8.4 billion hit to annual net interest income, driven by its exposure to mortgage prepayment risk, while the figure for JP Morgan is $2.6 billion. But capital levels could be boosted by the surging values of securities portfolios.

JP Morgan’s decision to switch from cash to securities a year ago is starting to look well timed. It might have upended the repo market, but it has already turbocharged the bank’s capital ratio as US treasury yields plunged. Bank of America and other large banks that built up mortgage-backed securities holdings in earlier years are still working through an overhang of losses, which are postponing any capital benefits.

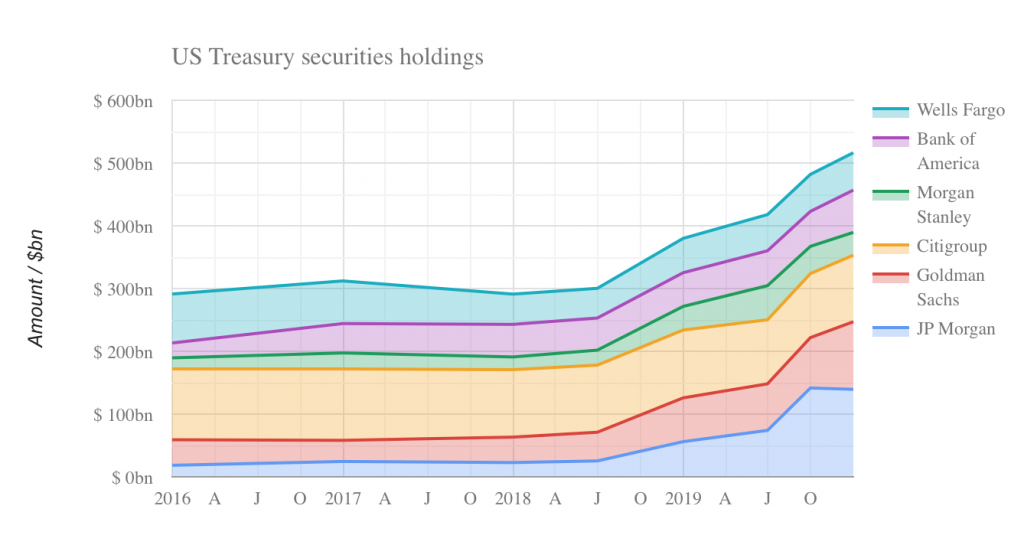

JP Morgan, which bought $125 billion of treasuries and agency bonds in the first three quarters of last year, reported $7 billion of unrealised gains on the portfolio for the full year. Of that amount, almost $3 billion was added to the bank’s Common Equity Tier 1 capital, as a consequence of a regulatory change that took effect in 2018.

Goldman Sachs bought $27 billion of treasuries in the fourth quarter, and is likely to join JP Morgan in reporting record gains for the first quarter of this year, after 10-year yields fell below one per cent.

Now consider the other big banks like Citigroup, Bank of America and Wells Fargo, that have accumulated large portfolios of agency mortgage-backed securities. Bank of America, whose MBS portfolio is $268 billion in size, took a hit to its equity of $6.6 billion from the portfolio last year, even as its bonds gained $6 billion in value, according to regulatory filings compiled by Risky Finance.