When Covid-19 sent corporate bonds into a tailspin in March, it set in motion a game of chicken at overleveraged companies. Like James Dean and his rivals in the movie Rebel Without A Cause, the companies and their bondholders were like drivers racing towards a cliff.

Should investors accept a painful write down on their bonds in order to keep companies alive and avoid even worse pain later on? Or should they call the company’s bluff and insist on full repayment of their debt?

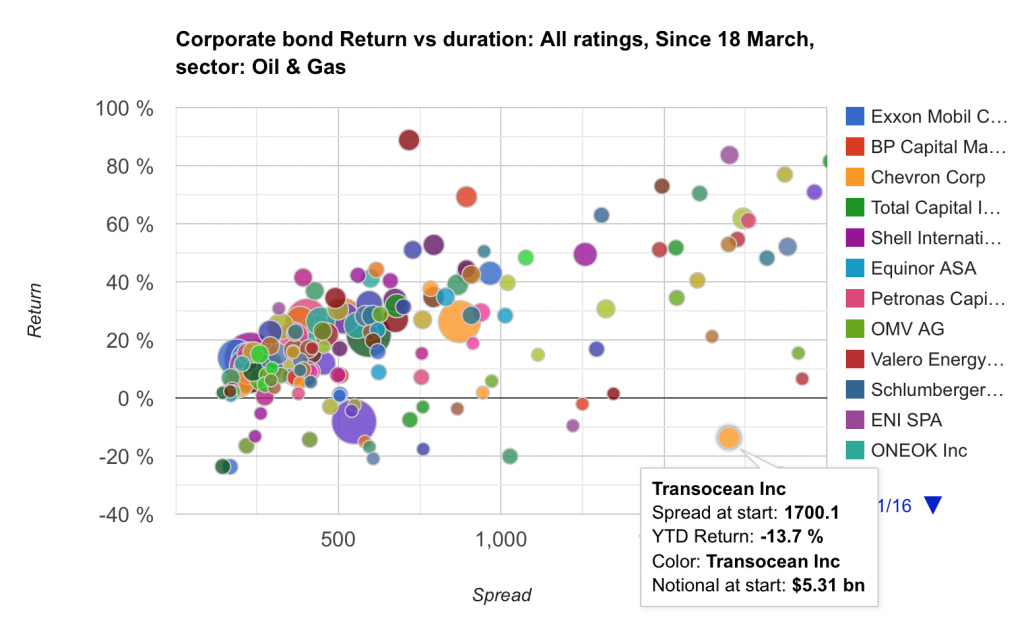

The Risky Finance corporate bond tool provides a ringside seat on some of these scenarios. Take the sector whose spreads declined the most on average since March – Oil & Gas. Investors in high yield bonds who bought that month have seen returns of 300% or more, while investment grade bonds have provided a 30% return since then.

But there was also survivorship bias lurking behind this rosy picture. The latest data doesn’t include the 19 US oil and gas producers in the iBoxx index that have filed for bankruptcy since the lockdowns began, defaulting on $21 billion of bonds. We’ve created a new tool to track this, looking for issuers that have left the index between two specified dates. This isn’t a surefire predictor of bankruptcy – a company might buy back its bonds for example – but for high yield issuers it comes pretty close.

Levelling the Playing Field

Levelling the Playing Field

Barclays and Labour's growth plan

Barclays and Labour's growth plan

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Dimon rolls trading dice with excess capital

Dimon rolls trading dice with excess capital