Commodity prices hit a 10-year high last month, as manufacturers scramble to the meet the backlog of consumer demand built up during the pandemic. Demand for raw materials is also being shaken up by a generational shift in industries that contribute to climate change, such as the automotive sector.

Consider how carmaker Volkswagen reported a €1.4 billion quarterly gain on commodity hedges, after placing derivative bets on metals such as nickel as part of its race towards electric vehicles. Such trades highlight the role of banks, exchanges and other intermediaries in this overheated but ESG friendly market.

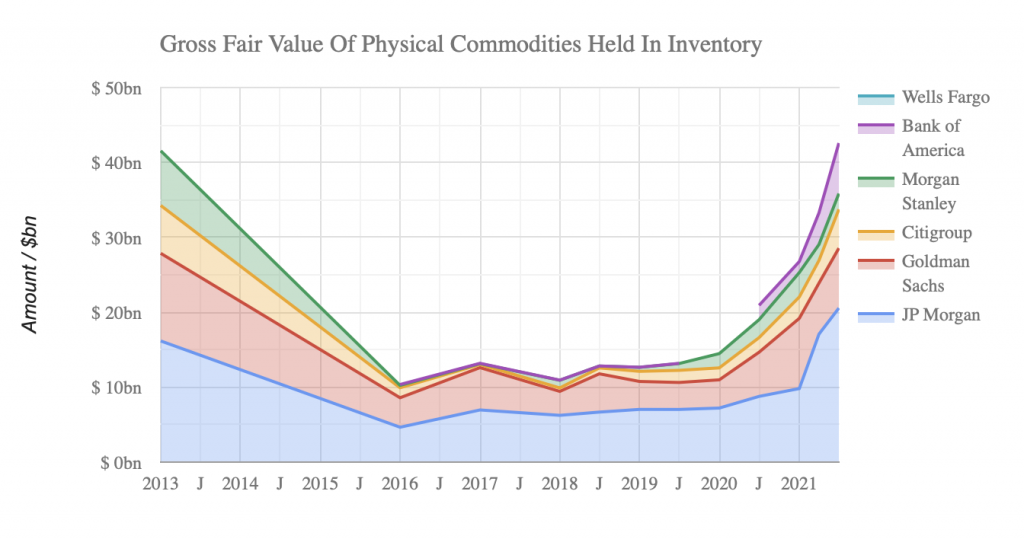

Now, Risky Finance can reveal that holdings of physical commodities at the top six US banks breached a 9-year high of $40 billion at the end of June, while notional amounts of commodity derivatives increased to $2.3 trillion. Evidence from European banks is more scarce, but limited disclosures suggest that exposures have surged here too.

Levelling the Playing Field

Levelling the Playing Field

Barclays and Labour's growth plan

Barclays and Labour's growth plan

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Dimon rolls trading dice with excess capital

Dimon rolls trading dice with excess capital