In this era of easy central bank money and investors hungry for yield, it takes a lot to actually distress a whole sector of corporate bonds. But consider what has finally happened to debt issued by Chinese companies, two years after we flagged the rapid growth of their borrowing.

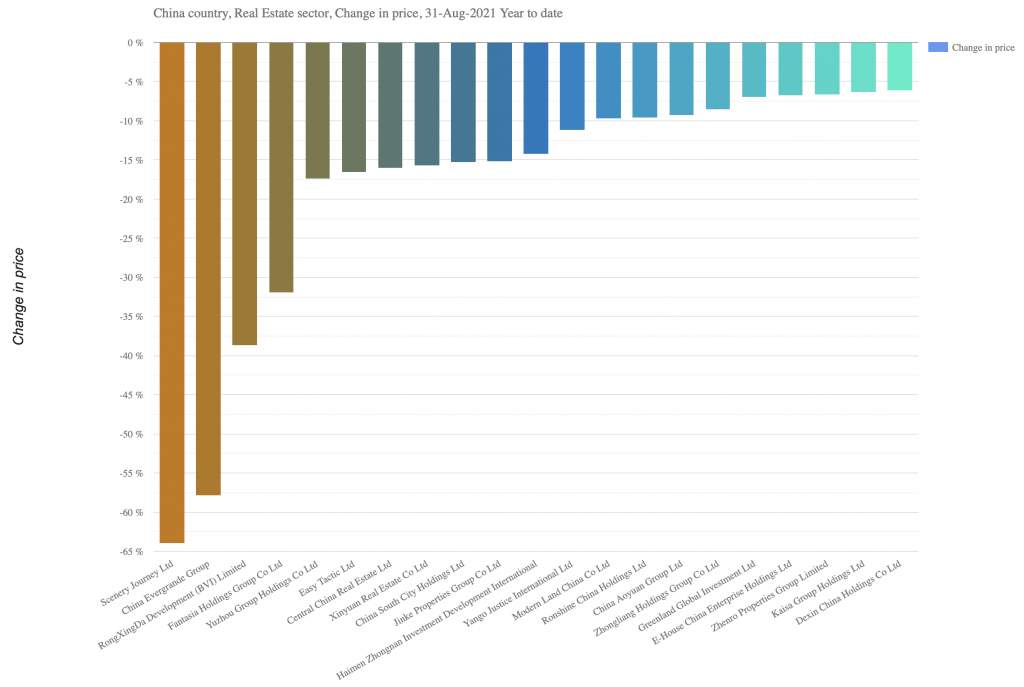

Real estate is the most affected sector, and Evergrande, now teetering on the brink of default, is the most prominent example. The company’s $15 billion of dollar-denominated bonds tracked by Markit iBoxx were worth an average of 42 cents on the dollar at the end of August. Other smaller issuers in that sector have also plunged in value – such as Scenery Journey and RongXingDa Development. We can see them in the Risky Finance corporate bond tool, ranked according to the greatest price decline this year.

With 300 square kilometres of total floor area and land reserves across China, Evergrande has desperately been trying to deleverage this year but seems to have run out of liquidity. Its bond prices are implying a painful restructuring for debtholders, who include thousands of domestic small investors.

Comments are closed.

[…] bubble back in 2019, when issuers were flocking to raise funding from dollar-based investors, and then in September 2021, when the market was starting to […]