The Fed has another clubby London institution in its sights. No, not Libor but the London Metal Exchange and the shadowy world of over-the-counter commodity derivatives.

On 4th May, auto giant Volkswagen bragged to shareholders about a €3.8 billion fair value gain in commodity hedges during the first quarter of 2022. The company was less candid about its exposure to the London Metal Exchange, which came close to disaster just six weeks before VW announced these results.

According to its 2021 annual report, VW had €2.9 billion of notional nickel hedges in place. News reports say that a considerable amount was placed with the LME, as well as large banks that dominate over-the-counter commodity derivatives. Skyrocketing commodity prices have highlighted the importance of such hedging counterparties for trades like VW’s.

According to the minutes of the 5 May Fed’s Open Markets Committee meeting, released on 25 May, “the trading and risk-management practices of some key participants in commodities markets were not fully visible to regulatory authorities”. That’s an understatement given the turmoil of March, when the LME shut down trading in nickel after Chinese nickel producer Tsangshan Holding Group was unable to pay margin calls to JP Morgan and other OTC derivative counterparties.

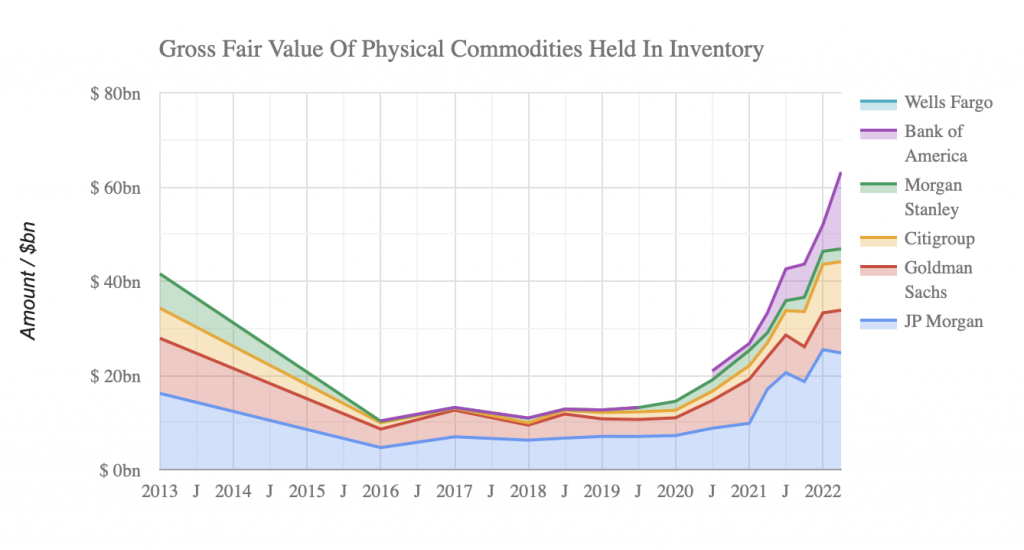

This could be a financial stability problem, says the Fed and it’s easy to see why looking at the balance sheets of the large banks the Fed regulates. Ten months ago, we noted that the value of physical commodities held on the balance sheets of the largest six banks had reached a record $40 billion, the largest amount since 2012.

As of the end of March, that figure is now

Comments are closed.

[…] Regulators zero in on commodities […]