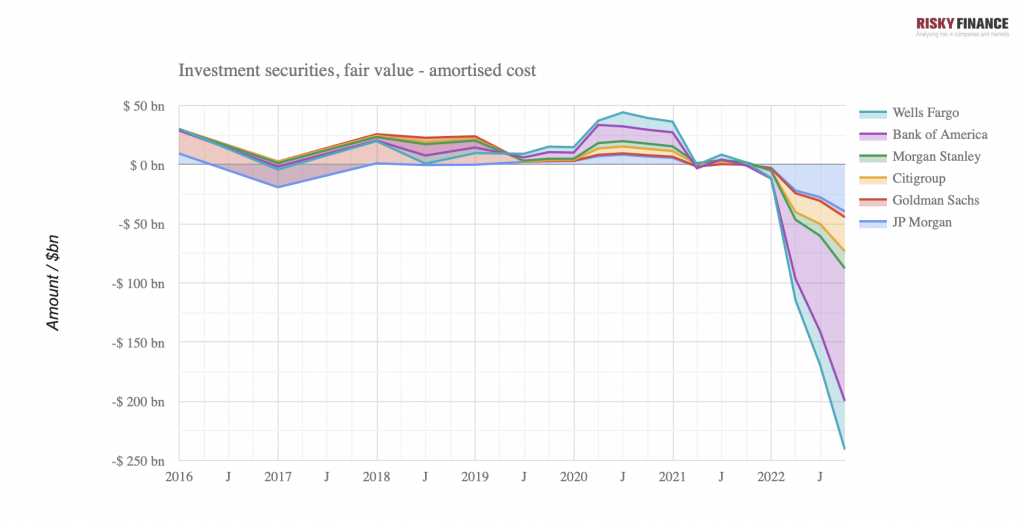

Starting four years ago, the largest US banks thought it would be a smart move to invest their cash in treasury or mortgage-backed securities rather than lend out the money. Rising interest rates have now caused the values of these bonds to plummet by a total of $250 billion, according to recent filings.

To avoid recording losses on them, the banks are forced to sit on the bonds, but the low yields earned on the bonds reduce the amount they can pay to depositors. Using the latest updates to the Risky Finance banking tool, we explore how these trillion-dollar portfolios now dominate the banks’ thinking on interest margins and deposit rates.

The story begins in 2018, when JP Morgan began a pivot from cash to securities, which caused a hiccup in the US repo market. Assigning low risk weightings to government bonds or MBS, Basel rules encouraged the trend. Accelerated by the pandemic, portfolios of US treasury bonds, agency MBS and other investments at the top six US banks steadily grew to a total of $2.2 trillion by early 2022.

Levelling the Playing Field

Levelling the Playing Field

Barclays and Labour's growth plan

Barclays and Labour's growth plan

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Dimon rolls trading dice with excess capital

Dimon rolls trading dice with excess capital