After years of laissez-faire, the UK government is scrabbling for an industrial policy in the strategically important semiconductor sector. A committee of MPs criticised the government’s sluggish approach this week.

The big trophy of such a policy would be the chipmaker ARM Holdings. Seven years ago, this British tech champion dominated the FTSE All-share index’s tech sector. But since then, the concept of UK-owned companies has been whittled away, as our visualisation shows.

|

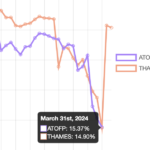

Understanding the chart

|

In 2016, after the Brexit vote caused sterling to plummet, ARM was snapped up for £24 billion by Masayoshi Son’s Softbank. By mid 2022, after posting billions in losses on tech investments, Softbank was seeking to offload ARM, and the UK government was lobbying hard for a London listing.

Comparing the change in total market cap for the FTSE All-share with the S&P 500 index between 2016 and now shows why Son favoured a US listing: The S&P 500 grew 70% (to $35 trillion market cap) over the seven-year period compared with 20% for the FTSE All-share.

Given that a $60 billion ARM IPO would amount to 2% of the FTSE All-share’s market cap but 0.2% of the S&P, we can see why three prime ministers have been trying to lure ARM back. But over the past seven years, the story of this index has been one of companies taking flight, never to return.

Levelling the Playing Field

Levelling the Playing Field

Barclays and Labour's growth plan

Barclays and Labour's growth plan

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Plummeting bonds reflect souring UK mood for outsourcing and privatisation

Dimon rolls trading dice with excess capital

Dimon rolls trading dice with excess capital